EU-EEA Agreement on Sustainability

with an emphasis on sustainable business operations and investments by institutional investors

The purpose of this website is to make it easier for Festa member companies, other companies, investors, students and other stakeholders to familiarize themselves with the content of these systems and rules and to better enable them to utilize and implement them in their work. Here is information on EU legislation that is related to facilitating access to capital from institutional investors for companies that base their operations on sustainable business models. The focus is first on the EU Green Deal and the Community Action Plan on Financing Sustainable Growth. This is followed by a review of various important EU acts (regulations and directives) that are relevant to the matter. There is then an overview of various definitions, references to educational materials and a discussion of how the acts are implemented in the EEA Agreement.

About the EU Green Deal and the Action Plan on Financing Sustainable Growth

The EU's Green Deal - A European Green Deal - was launched in 2019. Its goal is to lead the European economy towards becoming the first climate-neutral economy.

On some key acts and standards related to the Green Deal and the Sustainable Finance Action Plan

EU Taxonomy - EU Regulation No. EU/2020/852, on the EU Taxonomy for Sustainable Business Operations

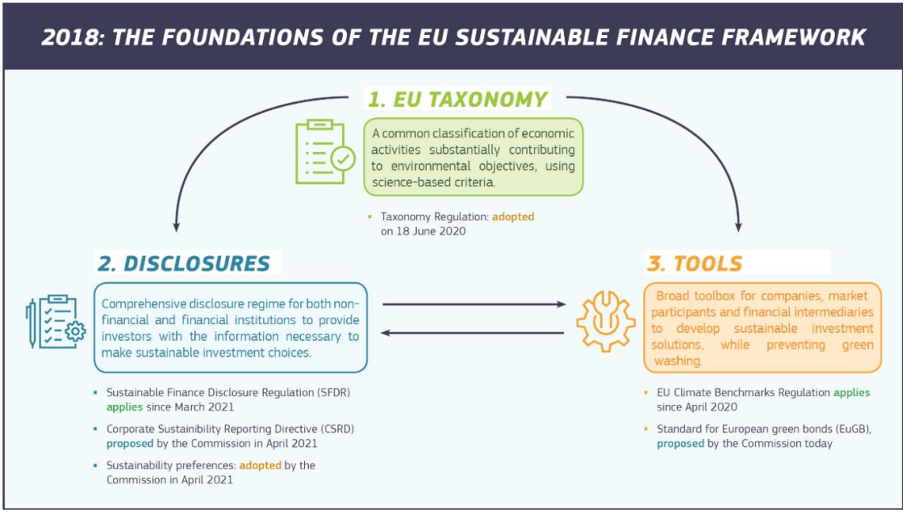

Here is an overview of some key EU instruments that are part of the Union's Action Plan on Financing Sustainable Growth, cf. the 2018 plan that was updated in 2021, see more in the introduction.

Flokkunarkerfi ESB skilgreinir hvað telst umhverfislega sjálfbær starfsemi fyrirtækja. Þar eru sett viðmið sem skilgreina að hvaða marki atvinnustarfsemi telst umhverfislega sjálfbær og hversu sjálfbær rekstur fyrirtækja er heilt yfir; þá mælt sem hlutfall veltu, fjárfestingarútgjalda eða rekstrarkostnaðar. Flokkunarkerfið er liður í að vinna gegn grænþvotti. Hún gildir m.a. um stór fyrirtæki sem og stofnanafjárfesta eins og verðbréfasjóði, banka, tryggingafélög og lífeyrissjóði.

There are six environmental goals.

1. Climate change mitigation

2. Aðlögun að loftslagsbreytingum

3. Sustainable use and protection of water and marine resources

4. Umbreyting yfir í hringrásarhagkerfi

5. Pollution prevention and control

6. Verndun og endurheimt líffræðilegrar fjölbreytni og vistkerfa

For an activity to be considered environmentally sustainable, it must contribute significantly to one or more of these six environmental objectives. Furthermore, the activity must not cause significant harm to other environmental objectives. It must also meet technical assessment criteria set out in the "delegated regulations" adopted on the basis of the Classification Regulation. In addition, minimum protective measures are required.

SFDR - Regulation EU/2019/2088, on identifying sustainability risks in portfolios and explaining them to end investors

Um SFDR í stuttu máli

The SFDR (Sustainable Financial Disclosure Regulation) applies to financial market participants such as banks, mutual funds, pension funds and insurance companies. It sets out the guidelines on how they must inform the end investor (owner of the assets) how to manage and disclose sustainability risks in portfolios. Portfolios are to be classified into three categories according to their focus on sustainability:

· Gray

· Light green

· Greens

The Regulation and the delegated regulation provide detailed guidance on the obligations of portfolio managers and advisors. The focus is on improved disclosure, anti-greenwashing, risk management, integration of ESG (Environmental, Social and Governance) analysis into the investment process and more targeted disclosure.